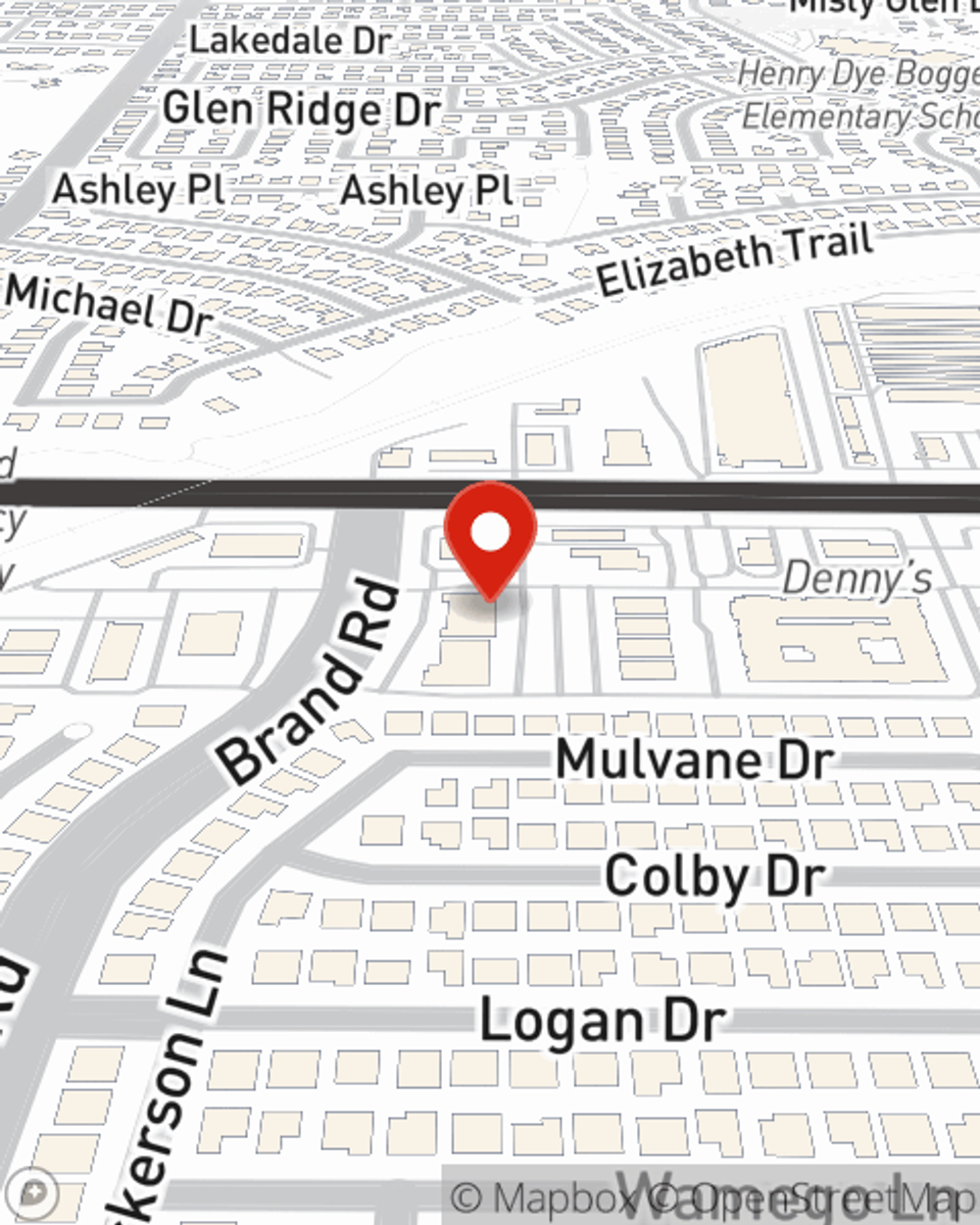

Business Insurance in and around Murphy

Looking for insurance for your business? Look no further than State Farm agent Sam McMillin!

Almost 100 years of helping small businesses

Help Prepare Your Business For The Unexpected.

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Sam McMillin help you learn about your business insurance.

Looking for insurance for your business? Look no further than State Farm agent Sam McMillin!

Almost 100 years of helping small businesses

Surprisingly Great Insurance

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a HVAC company or a real estate agent or you own a clothing store or a donut shop. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Sam McMillin. Sam McMillin is the agent who can relate to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

Call or email the terrific team at agent Sam McMillin's office to find out about the options that may be right for you and your small business.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Sam McMillin

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.